Why is it important to close the books fast? Is there a connection between speed, quality, and value to the business? Month-end closing is one of the most important processes of Finance, and great value is to be had from a streamlined, fast, and good process with subsequent great confidence in the figures. But which are the barriers to a successful fast-close and how can you tackle them?

Fast close for higher quality and value in the month-end closing process

The statement "We close the books in three days" says much about a Finance function according to most Finance professionals, since a streamlined month-end closing process is a central indicator of quality and efficiency.

On the contrary, an unstructured and undefined month-end closing process is an indication of the opposite. It affects the quality negatively and is cost-intensive and time-consuming for the employees. That's why many want a fast-close, though it may be hard to succeed.

Which are the barriers to fast close?

When it is difficult to be successful with fast close, the reason should normally be found in one or more of these circumstances:

- Unstructured and inconsistent processes

- A lack of policies

- System challenges

- Blurred distribution of roles and responsibilities.

If your company is negatively affected by one or more of these challenges, it will be difficult to perform an efficient, high-quality month-end closing process. Therefore, it's important to find out where the challenges are so that you know where to take action. In this article, we have chosen to stress the process element, which is a recurrent theme in fast-close projects.

Month-end optimisation based on the 7R model

Though the advantages of a solid fast-close process are obvious, it may be difficult to define the look of future optimum processes.

Often, you should start somewhere else - namely, by mapping how the process looks today and understanding which activities are involved.

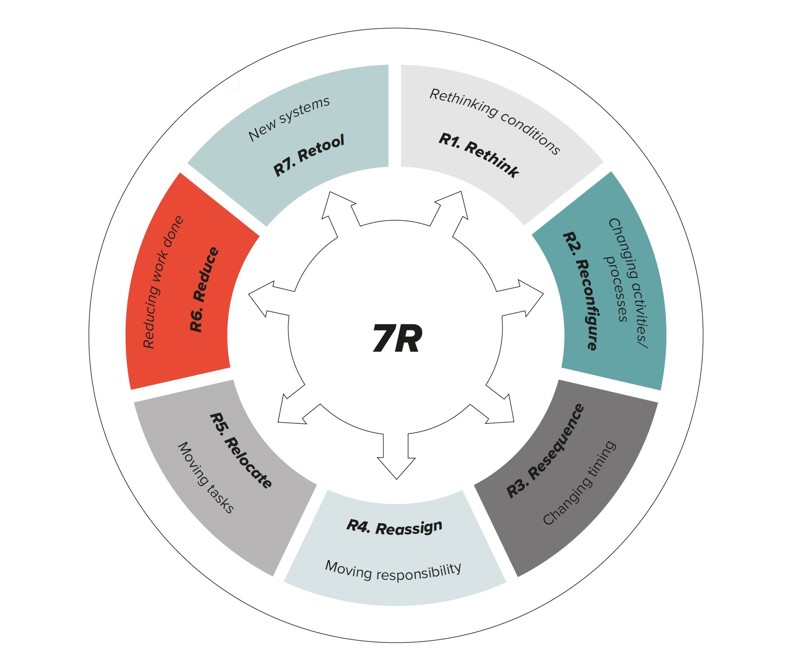

Not two projects are completely alike, but in almost all the fast-close projects with which we help our customers, we review and evaluate each individual work procedure and process of the month-end closing process based on the 7R model.

Figure 1: Basico's 7R question frame to processes

1. Rethink (Why)

We must test each individual process and ask why we perform this process, and which value it adds to the final product.

Example:

Many companies spend much time on a very detailed allocation of costs to customers, products, markets, etc. But often this exercise does not add value for the recipient of the management reporting - and the exercise is very time-consuming.

2. Reconfigure (How)

Can we in any way change the contents of each process step? Could the composition of the activities in the process be different? What is best practice? Can we get inspiration from other companies or industries, for example through benchmarking?

Example:

By implementing a good PO process, we change how we do things. It ensures both business-related and accounts-related optimisation - while being useful for the timing, just as the internal control is strengthened from being detective to being preventive. It also ensures faster and improved quality of accruals.

3. Resequence (When)

Can we change the times? Can we move it to the end of the month? Do we have to make it at the same time as the month-end closing? Can we improve part of the work and complete it later?

Example:

Many employees reconcile payroll-related accounts in the beginning of the month though they often have all relevant information earlier. Therefore, the reconciliation of payroll-related accounts should be handled earlier during the month-end closing process.

4. Reassign (Who)

Can we make others do this? Someone cleverer, some less expensive, someone placed somewhere else in the organsation, someone with better insight and/or completences - or where it would be more natural? Many controls are made to late in the month-end closing process, thereby increasing the time spent correcting errors and reducing the quality.

Example

Blurred roles and responsibilities result in too much quality control of subsidiaries' monthly accounts often being placed in HQ though much of this work could be made better and less expensive locally.

5. Relocate (Where)

Where is the bottleneck? Do we have a detailed overview of who and when the individual departments and employees are overloaded during the month-end closing process?

Example

It's important to review the individual employees'/departments' workload during the month-end closing process. Often, too few employees have too many tasks during this critical period. In our experience, it is always possible to reallocate some tasks. It would make the month-end closing process more robust and secure greater employee satisfaction.

6. Reduce (How much)

Is it possible to reduce the number of processes flows or the quality requirements? Can we use classical audit methods to reduce the workload?

Example

If you have made a systematic risk assessment of all your balance sheets, it's possible to reduce the reconciliation and documentation work on low-risk balance sheets. This will also allow you more time to spend on your high-risk accounts. The risk assessment will probably also allow you to reduce the reconciliation frequency on some of your balance sheets.

7. Retool (What)

Can we use the technology better? Can we automate sub-tasks and activities? Excel still has a much too prominent role technically supporting most companies' month-end closing process.

Example

In many cases, process automations by means of, for example, WinAutomation could almost eliminate many of the transaction-demanding processes during the month-end closing period.

Automation can also increase the quality by ensuring the availability and completeness of the data sets used for the reporting.

We dare promise that a structured review of your month-end closing process will always secure a faster and more efficient process - and almost always increase quality.

Would you like to know more?

Normally, we can reduce the number of work days spent on the month-end closing process by 25-40 per cent through operational measures that our customers succeed in implementing.

You are, of course, welcome to contact us for a non-binding talk about the potential in your company or if you want inspiration for your fast-close project.

en

en

da

da